Implied volatility (IV) is the volatility of an asset derived from changes in value of corresponding option in such way that if we input IV into option pricing model, it will return theoretical value equal to the current option value. Contrary to historical volatility, IV is the volatility forecast for price of the underlying asset from current time ![]() to option expiration

to option expiration ![]() . Let’s quickly introduce the Black-Scholes option pricing model. There are multiple ways to derive BSE and you can review them here. The brief solution of BSE can be found here. So the familiar BSE form is

. Let’s quickly introduce the Black-Scholes option pricing model. There are multiple ways to derive BSE and you can review them here. The brief solution of BSE can be found here. So the familiar BSE form is

(1) ![]()

where

![]() – option value,

– option value,

![]() – underlying asset spot price,

– underlying asset spot price,

![]() – risk-free interest,

– risk-free interest,

![]() – current time, date of expiry, time to expiry,

– current time, date of expiry, time to expiry,

![]() – volatility (in our case implied volatility).

– volatility (in our case implied volatility).

The solution of (1) for value of an call or put option at time ![]() can be expressed as

can be expressed as

(2) ![]()

where

![]()

![]()

![]() is strike price of an option and

is strike price of an option and ![]() is value of normal CDF at particular points

is value of normal CDF at particular points ![]() . Recall that normal CDF is written

. Recall that normal CDF is written

![]()

Do you see how deeply ![]() is buried? We see that

is buried? We see that ![]() and

and ![]() and since there doesn’t exist the closed form solution of

and since there doesn’t exist the closed form solution of ![]() the

the ![]() can’t be expressed analytically. That’s why we use numerical methods and approximation to evaluate implied volatilities. Familiar widely used numerical approaches are Newton-Raphson or secant method. Approximation of IV can be estimated by Bharadia-Christopher-Salkin(1996) model or Corado-Miller(1996) model. Among the latest and most effective estimators we can sort Hallerbach(2004), Jaeckel(2006) and Jaeckel(2013).

can’t be expressed analytically. That’s why we use numerical methods and approximation to evaluate implied volatilities. Familiar widely used numerical approaches are Newton-Raphson or secant method. Approximation of IV can be estimated by Bharadia-Christopher-Salkin(1996) model or Corado-Miller(1996) model. Among the latest and most effective estimators we can sort Hallerbach(2004), Jaeckel(2006) and Jaeckel(2013).

For purpose of this article let’s show how to implement just the most basic B-C-S model and secant method.

The B-C-S model is derived as

(3) ![]()

where

![]() – time to option expiration,

– time to option expiration,

![]() – current option value,

– current option value,

![]() – underlying asset spot price,

– underlying asset spot price,

![]() – option strike price(

– option strike price(![]() is discounted strike price).

is discounted strike price).

The secant numerical method is given by

(4) ![]()

where

![]() is theoretical option value from (2).

is theoretical option value from (2).

Algorithm itself works as follows(suppose ![]() computation for one specific

computation for one specific ![]() ):

):

- Compute

using (3).

using (3). - Compute theoretical value of an option

using (2).

using (2). - Set initial values(initial guess) for secant method, that is

- and

.

. - These temporary variables will change in the secant method loop. Keep in mind that the iterator in (4) of the secant loop is

(not

(not  !).

!). - Compute approximation error(last product on the left side of (4)).

- Compute new

using (4).

using (4). - Compute new

using (2)

using (2) - If error < accuracy threshold then last

is our

is our  from secant method alias implied volatility. Proceed to the next

from secant method alias implied volatility. Proceed to the next  .

. - If error is > accuracy threshold go back to step 6 (proceed to the next

) and don’t forget you need to recompute new

) and don’t forget you need to recompute new  values. Use

values. Use  from last secant iteration (note that initial values from step 3. and 4. will not be used in 2nd secant iteration). On every new iteration,

from last secant iteration (note that initial values from step 3. and 4. will not be used in 2nd secant iteration). On every new iteration,  variables become

variables become  variables and new

variables and new  variables are computed.

variables are computed.

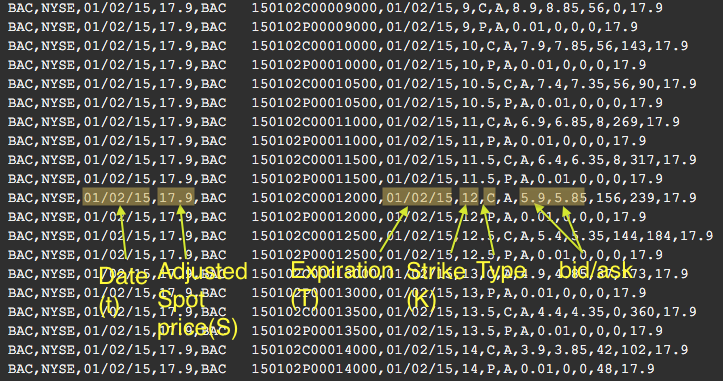

I will use historical EOD option chain data for BAC stock.

Fig.3 Example option chain .csv file for BAC stock.

If you are wading through my intro to volatility thoroughly you may want to download the example option chain. Option data are very expensive and tough to store and manipulate so it’s nearly impossible to find them free. So now we need to prepare data for IV calculation as follows:

- Use optionparse() function for importing the .csv option chain into matlab table.

table = optionparse('path/to/datafile','ivolatility','equity');

- Now we extract dates

, adjusted stock spot prices

, adjusted stock spot prices  and we choose call options with strike

and we choose call options with strike  , time to expiry

, time to expiry  and the ‘risk-free’ interest rate be

and the ‘risk-free’ interest rate be  which was T-Bill rate in the early 2015. Let me point out that in practice

which was T-Bill rate in the early 2015. Let me point out that in practice  “constant” will not be constant because we will not find such options at every time

“constant” will not be constant because we will not find such options at every time  which have exactly half a year expiration. Only finite number of options is offered every

which have exactly half a year expiration. Only finite number of options is offered every  . So our

. So our  will be variable. At every

will be variable. At every  I choose the first option with

I choose the first option with  and

and  . Following code finds forementioned options.

. Following code finds forementioned options.

% find dates

[~,ia,ib] = unique(table.data.date,'first','legacy');

t = table.data.date(ia);

S = table.data.adjusted_stock_close_price(ia);

% time to expiration in N/252 fraction, for simplicity I don't consider holidays, in practice you should

Tte = yearfrac(table.data.date,table.data.expiration,13);

% search options with expiration T_t and strike K

T_t_const = 0.5;

K = 15;

% expiration filter

ic_start = ia + accumarray(ib,Tte,[],@(x) find(x>=T_t_const,1)) - 1;

ic_end = ia + accumarray(ib,Tte,[],@(x) find(x<=T_t_const+0.5,1,'last')) - 1;

idExpiration = zeros(size(Tte));

% strike filter

id = zeros(length(ic_start),1);

for i=1:length(ic_start)

temp = find(table.data.strike(ic_start(i):ic_end(i)) == K,1);

if ~isempty(temp)

id(i,1) = find(table.data.strike(ic_start(i):ic_end(i)) == K,1);

else

id(i,1) = NaN;

end

end

% uncomment proper option

idTK = ic_start + id - 1; % call options

% idTK = ic_start + id; % put options

% time to expiry at each time t

T_t_var = Tte(idTK);

% let the value of the option be (ask+bid)/2. V is vector with filtered

% options

V = (table.data.ask(idTK) + table.data.bid(idTK))/2;

- Our variables and constants are ready. I will demonstrate IV computation for

.

.

1. Calculate initial IV estimate ![]() by B-C-S model (3).

by B-C-S model (3).

t = 1; r = 0.001; delta = (1/2)*(S(t) - K*exp(-r*T_t_var(t))); % (3) sigma_BCS(t,1) = sqrt(2*pi-T_t_var(t)) * (V(t)-delta)/(S(t)-delta); % (3)

2. Compute theoretical value of an option ![]() using (2).

using (2).

d1 = (log(S(t)/K) + (r+1/2*sigma_BCS(t,1)^2)*(T_t_var(t))) / sigma_BCS(t,1)*sqrt(T_t_var(t)); % (2)

d2 = d1 - sigma_BCS(t)*T_t_var(t);

BS(t) = S(t)*cdf('normal',d1,0,1) - K*exp(-r*T_t_var(t))*cdf('normal',d2,0,1); % (5) for call option

3. Set initial values(initial guess) for secant method, that is ![]() . Note that I smuggled in the initial error value and secant method accuracy.

. Note that I smuggled in the initial error value and secant method accuracy.

err_thr = 1e-4; % secant method error tolerance(accuracy) err = 1; % initial error value temp_sigma(1:2,1) = [0,sigma_BCS(t,1)];

4. and ![]() .

.

temp_BS(1:2,1) = [0,BS(t,1)];

5. Secant method, steps described in the code.

while err >= err_thr

% error update - step 6

err = (temp_BS(2,1) - V(t)) * ...

((temp_sigma(2,1) - temp_sigma(1,1)) / (temp_BS(2,1) - temp_BS(1,1))); % (7) error corresponding to last computed sigma

% sigma_{i+1} update - step 7

temp_sigma(3,1) = temp_sigma(2,1) - err; % new sigma from secant iteration

temp_sigma(1) = []; % old sigma no more needed in next loop

% BS(sigma_{i+1}) update - step 8

d1 = (log(S(t)/K) + (r+1/2*temp_sigma(2,1)^2)*(T_t_var(t))) / temp_sigma(2,1)*sqrt(T_t_var(t)); % (2)

d2 = d1 - temp_sigma(2,1)*T_t_var(t); % (2)

temp_BS(3,1) = S(t)*cdf('normal',d1,0,1) - K*exp(-r*T_t_var(t))*cdf('normal',d2,0,1); % (2) for call option

temp_BS(1) = []; % old BS(sigma) no more needed in next loop

end

9. If error < accuracy threshold then last ![]() is our

is our ![]() .

.

sigma_secant(t,1) = temp_sigma(2,1);

10. If error > accuracy threshold go to step 6 (next ![]() ).

).

You can download complete working BCS_secant() function here.

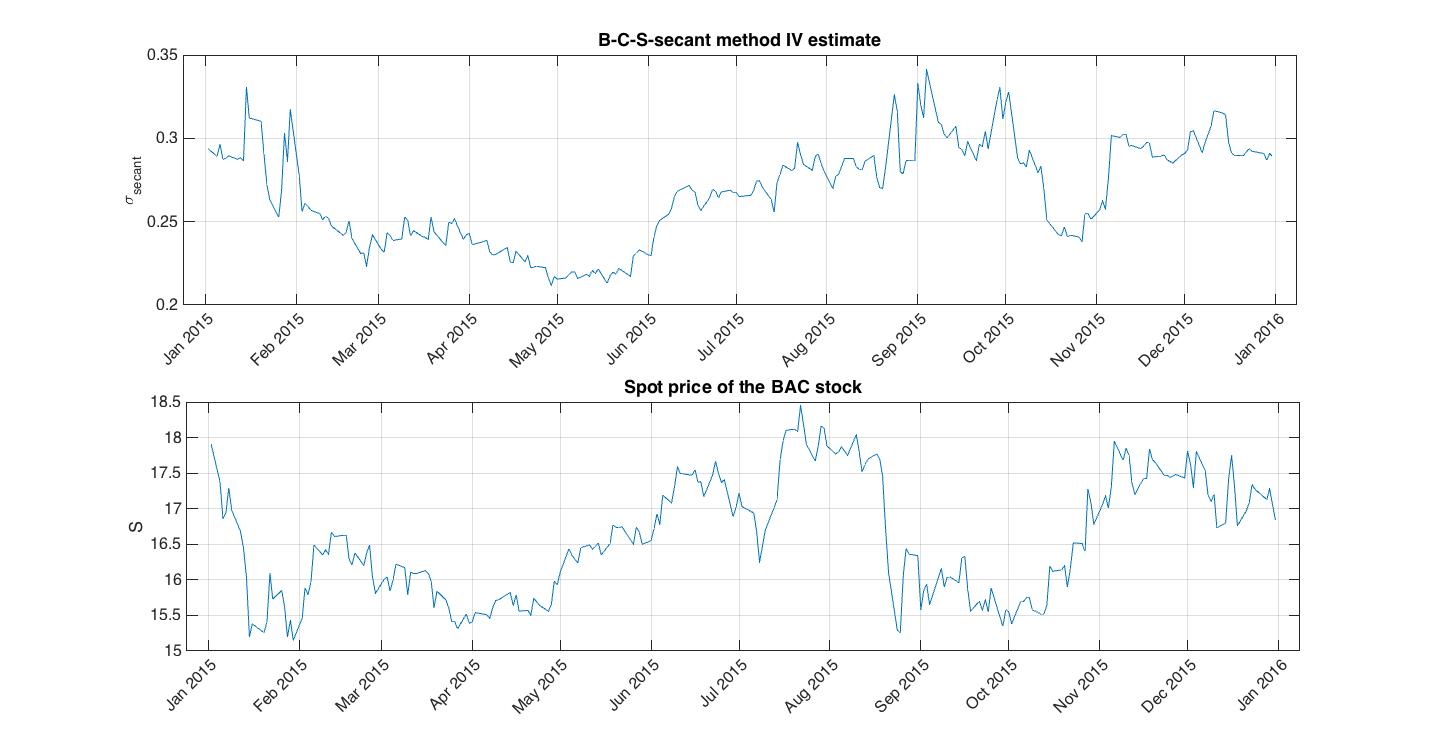

Fig.4 B-C-S-secant computed daily implied volatility for Bank of America stock in 2015

We can slowly move to the next concept of practical importance which ensues directly from implied volatility calculation. We have computed one IV value for every ![]() and we supposed that

and we supposed that ![]() where

where ![]() were fixed (“fixed” for

were fixed (“fixed” for ![]() because

because ![]() cannot be strictly constant). Clearly we can release this assumption and let the

cannot be strictly constant). Clearly we can release this assumption and let the ![]() be variables. For every

be variables. For every ![]() we now have not just one point but set of points which constitutes the implied volatility surface. If we now fix just

we now have not just one point but set of points which constitutes the implied volatility surface. If we now fix just ![]() at some time

at some time ![]() in

in ![]() we obtain values constituting implied volatility smile or implied volatility skew, if we fix just

we obtain values constituting implied volatility smile or implied volatility skew, if we fix just ![]() at some time

at some time ![]() we obtain implied volatility term structure.

we obtain implied volatility term structure.

Multitudes of volatility indexes (composites) are constructed using various setups in IV computation. Some of them average IV’s of stocks in indexes such a S&P500, DJIA, NASDAQ …, some of them average similar ETF’s etc. As was mentioned before such indexes measure expectation of volatility. For example have a look at the CBOE volatility indexes overview.