In this article you get familiar with basic concepts behind GARCH models family and practical use of it.

General properties, terms and notation of conditional variance models

Advantage of conditional variance models is that they better describe following time series properties:

- Returns of an asset have positive excess kurtosis[1] which means their PDF peak is sharper than the normal PDF peak. Tails of returns PDF often embody higher probability density than PDF shoulders, such the PDF has well-known fat-tails.

- Volatility tends to cluster into periods with higher and lower volatility. This effect means that volatility at some time must be dependent on its historical values say with some degree of dependence.

- Returns fluctuations have asymmetric impact on volatility. Volatility changes more after downward return move than after upward return move.

Consider the general form of conditional variance model

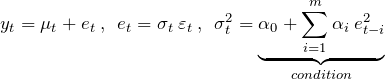

(1) ![]()

Firstly we see that value of dependent variable ![]() consists of mean

consists of mean ![]() and innovation

and innovation ![]() . In practice

. In practice ![]() can be chosen as conditional mean of

can be chosen as conditional mean of ![]() such that

such that ![]() where

where ![]() [2] is arbitrary historical information affecting value of

[2] is arbitrary historical information affecting value of ![]() . In other words we model every

. In other words we model every ![]() by suitable linear regress model or using AR[3] process. Often is sufficient use just fixed value

by suitable linear regress model or using AR[3] process. Often is sufficient use just fixed value ![]() or

or ![]() . Innovation

. Innovation ![]() consists of variance(volatility) root

consists of variance(volatility) root ![]() where

where ![]() [4] and i.i.d. random variable from normal or

[4] and i.i.d. random variable from normal or ![]() -distribution

-distribution ![]() or

or ![]() .

.

From fragmented notation above we can write general conditional variance model as is known in econometrics literature

(2) ![]()

Observe that innovations ![]() are not correlated but are dependent through

are not correlated but are dependent through ![]() term (later we will briefly see

term (later we will briefly see ![]() contains lagged

contains lagged ![]() ). If

). If ![]() is non-linear function then model is non-linear in mean, conversely if

is non-linear function then model is non-linear in mean, conversely if ![]() is non-linear then model is non-linear in variance which in turn means that

is non-linear then model is non-linear in variance which in turn means that ![]() is changing non-linearly with every

is changing non-linearly with every ![]() through a function of

through a function of ![]() . Since now we should know what autoregressive conditional heteroskedasticity means.

. Since now we should know what autoregressive conditional heteroskedasticity means.

ARCH

After discussion above we can quickly formulate the ARCH model which was introduced by Rober Engle in 1982. If we take (2) and specify condition(based on historical information ![]() ) for

) for ![]() we get ARCH(m) model

we get ARCH(m) model

(3)

where ![]() are i.i.d. random variables with normal or

are i.i.d. random variables with normal or ![]() -distribution, zero mean and unit variance. As mentioned earlier in practice we can drop

-distribution, zero mean and unit variance. As mentioned earlier in practice we can drop ![]() term thus get

term thus get

![Rendered by QuickLaTeX.com \[ y_t = e_t \>,\hspace{5pt} e_t = \sigma_t\>\varepsilon_t\>,\hspace{5pt}\sigma_t^2 = \alpha_0 + \sum \limit_{\tiny i=1}^{\tiny m} \alpha_i \> e_{t-i}^2 \]](http://mmquant.net/wp-content/ql-cache/quicklatex.com-20cc68a62f8bf3d308eafb275c559066_l3.png)

or regress mean with exogenous explanatory variables as

![Rendered by QuickLaTeX.com \[ y_t = \underbrace{\gamma_0 + \sum \limit_{\tiny i=1}^{\tiny k}\gamma_i \>x_{t,i}}_{\mu_t} \>+\> e_t \>,\hspace{5pt} e_t = \sigma_t\>\varepsilon_t\>,\hspace{5pt}\sigma_t^2 = \alpha_0 + \sum \limit_{\tiny i=1}^{\tiny m} \alpha_i \> e_{t-i}^2 \]](http://mmquant.net/wp-content/ql-cache/quicklatex.com-b3042f4ffe083eadd9db3bce06db6822_l3.png)

or use any other suitable model. Recall that significant fluctuation in past innovations will notably affect current volatility(variance). Regarding positivity and stationarity of variance ![]() , coefficients in (3) condition have to satisfy following constraints

, coefficients in (3) condition have to satisfy following constraints

![Rendered by QuickLaTeX.com \[ \alpha_0 > 0,\>\alpha_1 \ge 0,\>\cdots ,\>\alpha_m \ge 0,\hspace{5pt} \sum \limit_{\tiny i=1}^{\tiny m} \alpha_i < 1 \]](http://mmquant.net/wp-content/ql-cache/quicklatex.com-c1f33a764e34ae06e3af75ccd4ef6026_l3.png)

GARCH

GARCH model was introduced by Robert Engle’s PhD student Tim Bollerslev in 1986. Both GARCH and ARCH models allow for leptokurtic distribution of innovations ![]() and volatility clustering (conditional heteroskedasticity) in time series but neither of them adjusts for leverage effect. So what is the advantage of GARCH over ARCH? ARCH model often requires high order

and volatility clustering (conditional heteroskedasticity) in time series but neither of them adjusts for leverage effect. So what is the advantage of GARCH over ARCH? ARCH model often requires high order ![]() thus many parameters have to be estimated which in turn brings need for higher computing power. Moreover the bigger order

thus many parameters have to be estimated which in turn brings need for higher computing power. Moreover the bigger order ![]() is, the higher probability of breaking forementioned constraints there is.

is, the higher probability of breaking forementioned constraints there is.

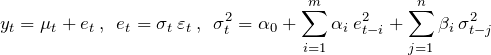

GARCH is “upgraded” ARCH in that way it allows current volatility to be dependent on its lagged values directly. GARCH(m, n) is defined as

(4)

where ![]() are i.i.d. random variables with normal or

are i.i.d. random variables with normal or ![]() -distribution, zero mean and unit variance. Parameters constraints are very similar as for ARCH model,

-distribution, zero mean and unit variance. Parameters constraints are very similar as for ARCH model,

![Rendered by QuickLaTeX.com \[ \alpha_0 > 0,\>\alpha_i \ge 0, \>\beta_j \ge 0,\hspace{5pt} \sum \limit_{\tiny i=1}^{\tiny m} \alpha_i + \sum \limit_{\tiny j=1}^{\tiny n} \beta_j < 1 \hspace{5pt}. \]](http://mmquant.net/wp-content/ql-cache/quicklatex.com-7cda4029abc80c15be9b7453a0dacc70_l3.png)

In practice even GARCH(1, 1) with three parameters can describe complex volatility structures and it’s sufficient for most applications. We can forecast future volatility ![]() of GARCH(1, 1) model using

of GARCH(1, 1) model using

![]()

where

![]()

is unconditional variance of innovations ![]() . Observe that for

. Observe that for ![]() as

as ![]() we get

we get ![]() . So prediction of volatility goes with time asymptotically to the unconditional variance. If you are interested how are derived mentioned results and further properties of GARCH and ARCH I recommend you read this friendly written lecture paper.

. So prediction of volatility goes with time asymptotically to the unconditional variance. If you are interested how are derived mentioned results and further properties of GARCH and ARCH I recommend you read this friendly written lecture paper.

GJR-GARCH

Finally we get to the model which adjusts even for asymmetric responses of volatility to innovation fluctuations. GJR-GARCH was developed by Glosten, Jagannathan, Runkle in 1993. Sometimes referred as T-GARCH or TARCH if just ARCH with GJR modification is used. GJR-GARCH(p, q, r) is defined as follows

![]()

![Rendered by QuickLaTeX.com \[ \sigma_t^2 = \alpha_0 + \sum \limit_{\tiny i=1}^{\tiny p} \alpha_i \> e_{t-i}^2 + \sum \limit_{\tiny j=1}^{\tiny q} \beta_j \> \sigma_{t-j}^2 + \sum \limit_{\tiny k=1}^{\tiny r} \gamma_k \> e_{t-k}^2 \> I_{t-k}\>,\hspace{5pt} I_t = \begin{cases} 1& \quad \text{if } e_t <0\\ 0& \quad \text{otherwise}\\ \end{cases} \]](http://mmquant.net/wp-content/ql-cache/quicklatex.com-c64112efb5249c5e83b728916599aec6_l3.png)

where ![]() are leverage coefficients and

are leverage coefficients and ![]() is indicator function. Observe that for

is indicator function. Observe that for ![]() negative innovations

negative innovations ![]() give additional value to volatility

give additional value to volatility ![]() thus we achieve adjustment for asymmetric impact on volatility as discussed at the beginning of the article. For

thus we achieve adjustment for asymmetric impact on volatility as discussed at the beginning of the article. For ![]() we get GARCH(m = p, n = q) model and for

we get GARCH(m = p, n = q) model and for ![]() we get exotic result where upward swings in return or price have stronger impact on volatility than the downward moves. Need to mention that in most implementations of GJR-GARCH we will find GJR-GARCH(p,q) where leverage order

we get exotic result where upward swings in return or price have stronger impact on volatility than the downward moves. Need to mention that in most implementations of GJR-GARCH we will find GJR-GARCH(p,q) where leverage order ![]() is automatically considered equal to order

is automatically considered equal to order ![]() . Parameters constraints are again very similar as for GARCH, we have

. Parameters constraints are again very similar as for GARCH, we have

![Rendered by QuickLaTeX.com \[ \alpha_0 > 0,\>\alpha_i \ge 0, \>\beta_j \ge 0\>,\hspace{5pt}\alpha_i + \gamma_k \ge 0 \>,\hspace{5pt} \sum \limit_{\tiny i=1}^{\tiny p} \alpha_i + \sum \limit_{\tiny j=1}^{\tiny q} \beta_j + \frac{1}{2}\sum \limit_{\tiny k=1}^{\tiny r}\gamma_k < 1 \hspace{5pt}. \]](http://mmquant.net/wp-content/ql-cache/quicklatex.com-441a4f34d8447404209bc5f5623afc36_l3.png)

Prediction for GJR-GARCH can be estimated as

![]()

If you are interested in analytical solutions for predictions of non-linear conditional variance models read Franses-van Dijk (2000).

Estimation of linear GARCH and non-linear GARCH models is done using MLE, QMLE and robust estimation.

Example: Estimating GARCH(m, n) and GJR-GARCH(p, q) with Matlab

Denotation: I was using ![]() as dependent variable, since now let

as dependent variable, since now let ![]() .

.

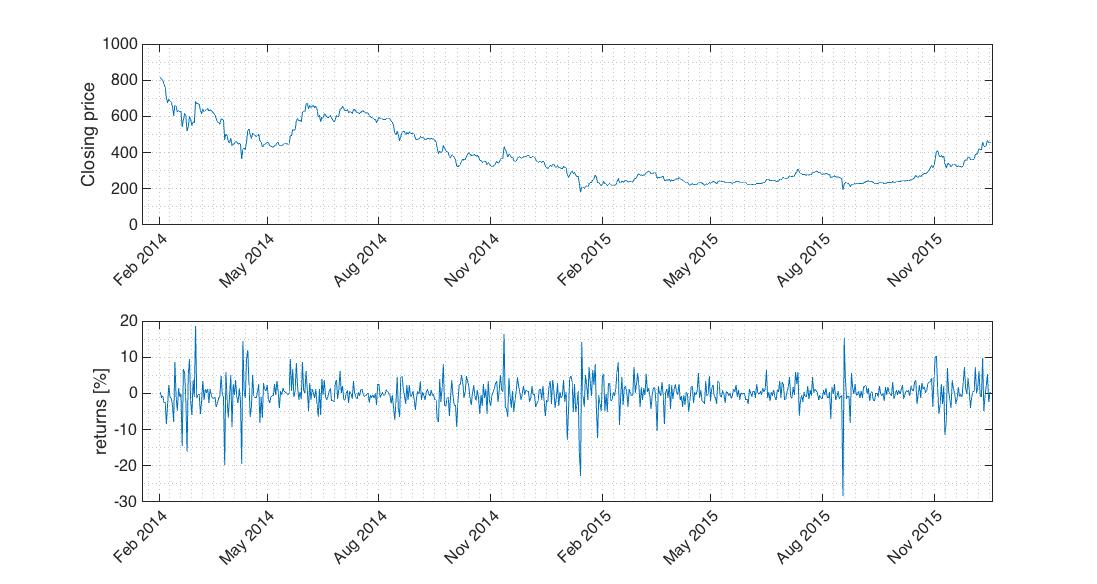

I will demonstrate GARCH(m, n) estimation procedure on returns of bitcoin daily price series which I used in earlier post about volatility range estimators. Let’s have look at input data.

C = BFX_day1_OHLCV(:,4);

date = BFX_day1_date;

%% Returns. Note that we don't know return for C(1) so we drop first element

r = double((log(C(2:end)./C(1:end-1)))*100); % scaled returns in [%] for numerical stability

e = r - mean(r); % innovations after simple linear regression of returns

C = C(2:end);

date = date(2:end);

%% Plot C and r

% C

figure1 = figure;

subplot1 = subplot(2,1,1,'Parent',figure1);

hold(subplot1,'on');

plot(date,C,'Parent',subplot1);

ylabel('Closing price');

box(subplot1,'on');

set(subplot1,'FontSize',16,'XMinorGrid','on','XTickLabelRotation',45,'YMinorGrid','on');

% r

subplot2 = subplot(2,1,2,'Parent',figure1);

hold(subplot2,'on');

plot(date,r,'Parent',subplot2);

ylabel('returns [%]');

box(subplot2,'on');

set(subplot2,'FontSize',16,'XMinorGrid','on','XTickLabelRotation',45,'YMinorGrid','on');

Fig.1 Volatility clusters in returns series are obvious at the first glance.

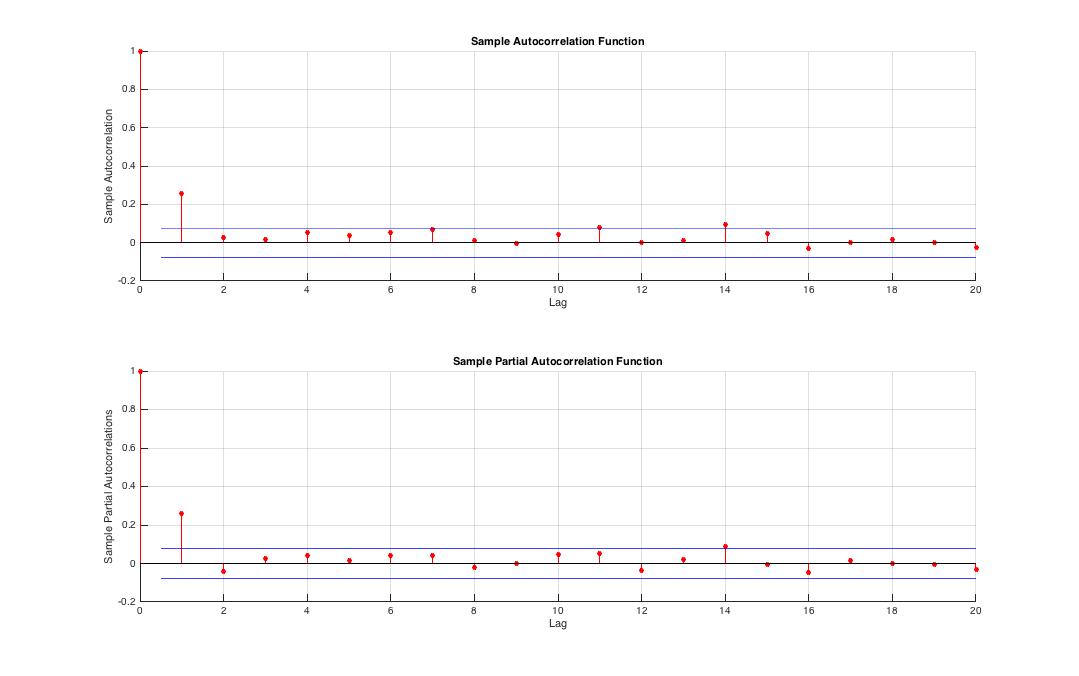

Let’s examine character of returns mean. Is ![]() conditioned by its lagged values? ACF, PACF and Ljung-Box test[5] help us in this decision. Note that

conditioned by its lagged values? ACF, PACF and Ljung-Box test[5] help us in this decision. Note that ![]() series is stationary with mean

series is stationary with mean ![]() very close to zero. We could use everywhere just

very close to zero. We could use everywhere just ![]() instead of innovations

instead of innovations ![]() but correct is to use innovations/residuals.

but correct is to use innovations/residuals.

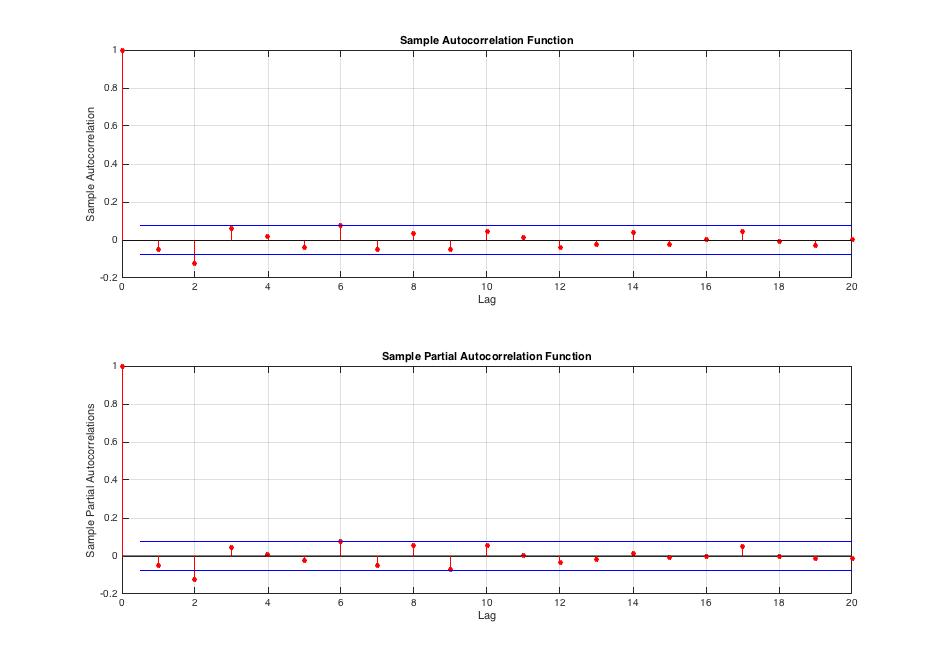

%% Autocorrelation of returns innovations - ACF, PACF, Ljung-Box test % ACF figure2 = figure; subplot3 = subplot(2,1,1,'Parent',figure2); hold(subplot3,'on'); autocorr(e); % input to ACF are innovations after simple linear regression of returns % PACF subplot4 = subplot(2,1,2,'Parent',figure2); hold(subplot4,'on'); parcorr(e); % input to ACF are innovations after simple linear regression of returns % Ljung-Box test [hLB,pLB] = lbqtest(e,'Lags',3);

Fig.2 Returns innovation series exhibits autocorrelation at ![]()

ACF and PACF show us that returns are autocorrelated. We can also reject Ljung-Box test ![]() hypothesis with

hypothesis with ![]() [6] thus there is at least one non-zero correlation coefficient in

[6] thus there is at least one non-zero correlation coefficient in ![]() .

.

Next we will check for conditional heteroskedasticity of returns by examining autocorrelation of squared innovations ![]() .

.

%% Conditional heteroskedasticity of returns - ACF, PACF, Engle's ARCH test % ACF figure3 = figure; subplot5 = subplot(2,1,1,'Parent',figure3); hold(subplot5,'on'); autocorr(e.^2); % PACF subplot6 = subplot(2,1,2,'Parent',figure3); hold(subplot6,'on'); parcorr(e.^2);

Fig.3 Squared innovation series exhibits autocorrelation at ![]() which tells us that variance of returns is significantly autocorrelated thus returns are conditionally heteroskedastic.

which tells us that variance of returns is significantly autocorrelated thus returns are conditionally heteroskedastic.

Let assure ourselves by conducting Engle’s ARCH test[7].

% ARCH test [hARCH, pARCH] = archtest(e,'lags',2);

ARCH test rejects ![]() with ridiculously small

with ridiculously small ![]() in favor of the

in favor of the ![]() hypothesis so returns innovations

hypothesis so returns innovations ![]() are autocorrelated – returns are conditionally heteroskedastic. Consider

are autocorrelated – returns are conditionally heteroskedastic. Consider ![]() as ‘lags’ input into the ARCH test. What do we expect

as ‘lags’ input into the ARCH test. What do we expect ![]() to be? Bigger lag we choose, bigger

to be? Bigger lag we choose, bigger ![]() we can expect. It is naturally caused by that we include more and more values that are not significantly autocorrelated in the ARCH test therefore probability of not-rejecting

we can expect. It is naturally caused by that we include more and more values that are not significantly autocorrelated in the ARCH test therefore probability of not-rejecting ![]() grows.

grows.

Here we go, we made sure that we can apply (1) to given data. After slight modification we have

![]()

where ![]() is conditional mean and

is conditional mean and ![]() is conditional innovation. We describe our

is conditional innovation. We describe our ![]() by AR-GARCH models by setting up the ARIMA model objects.

by AR-GARCH models by setting up the ARIMA model objects.

%% AR-GARCH model, ARIMA object

MdlG = arima('ARLags',2,'Variance',garch(1,1)); % normal innovations

MdlT = arima('ARLags',2,'Variance',garch(1,1)); % t-distributed innovations

MdlT.Distribution = 't';

This model corresponds to

(5) ![]()

(6) ![]()

where we suppose that ![]() is

is ![]() or

or ![]() and i.i.d. We will compare quality of both models using information criterions.

and i.i.d. We will compare quality of both models using information criterions.

Let’s proceed to parameters estimation.

%% Parameters estimation % normal innovations EstMdlG = estimate(MdlG,r); % t-distributed innovations EstMdlT = estimate(MdlT,r);

gives us following results for normally distributed innovations:

ARIMA(2,0,0) Model:

--------------------

Conditional Probability Distribution: Gaussian

Standard t

Parameter Value Error Statistic

----------- ----------- ------------ -----------

Constant -0.0567801 0.172784 -0.328618

AR{2} -0.0656668 0.0493691 -1.33012

GARCH(1,1) Conditional Variance Model:

----------------------------------------

Conditional Probability Distribution: Gaussian

Standard t

Parameter Value Error Statistic

----------- ----------- ------------ -----------

Constant 1.30152 0.216776 6.00402

GARCH{1} 0.831643 0.02415 34.4366

ARCH{1} 0.0868795 0.0155263 5.59563

Hence we can rewrite (5) and (6) as

![]()

![]()

where we have just one unknown – volatility or conditional variance of returns ![]() which we can recursively infer. We found out that

which we can recursively infer. We found out that ![]() in (5) thus has no explanatory power for returns as dependent variable. Moreover it seems that innovations autocorrelation is not strong enough to give statistical significance to

in (5) thus has no explanatory power for returns as dependent variable. Moreover it seems that innovations autocorrelation is not strong enough to give statistical significance to ![]() in (5) and to

in (5) and to ![]() . T-test[8] t-statistic for

. T-test[8] t-statistic for ![]() and

and ![]() don’t fall into the critical region so we can’t reject hypothesis about zero explanatory power of these two coefficients.

don’t fall into the critical region so we can’t reject hypothesis about zero explanatory power of these two coefficients.

For innovations from ![]() -distribution we get:

-distribution we get:

ARIMA(2,0,0) Model:

--------------------

Conditional Probability Distribution: t

Standard t

Parameter Value Error Statistic

----------- ----------- ------------ -----------

Constant -0.0651421 0.0895812 -0.727185

AR{2} -0.0728623 0.0350649 -2.07793

DoF 2.78969 0.325684 8.56564

GARCH(1,1) Conditional Variance Model:

----------------------------------------

Conditional Probability Distribution: t

Standard t

Parameter Value Error Statistic

----------- ----------- ------------ -----------

Constant 1.33968 0.575195 2.32909

GARCH{1} 0.742378 0.0554331 13.3923

ARCH{1} 0.257622 0.102234 2.51993

DoF 2.78969 0.325684 8.56564

Hence we can rewrite (5) and (6) as

![]()

![]()

where ![]() . In this case all estimated parameters except of

. In this case all estimated parameters except of ![]() have statistical significance.

have statistical significance.

We can also try to model variance using just pure GARCH(1,1) with constant ![]() in (5) .

in (5) .

%% GARCH without mean offset (\mu_t = 0) % normally distributed innovations EstMdlMdloffset0G = estimate(Mdloffset0G,r); % t-distributed innovations EstMdlMdloffset0T = estimate(Mdloffset0T,r);

We get similar results as with AR-GARCH approach because AR(2) plays insignificant role in AR-GARCH:

GARCH(1,1) Conditional Variance Model:

----------------------------------------

Conditional Probability Distribution: Gaussian

Standard t

Parameter Value Error Statistic

----------- ----------- ------------ -----------

Constant 1.35151 0.219309 6.16257

GARCH{1} 0.824422 0.024637 33.4627

ARCH{1} 0.0918974 0.0164784 5.57683

GARCH(1,1) Conditional Variance Model:

----------------------------------------

Conditional Probability Distribution: t

Standard t

Parameter Value Error Statistic

----------- ----------- ------------ -----------

Constant 1.30701 0.549996 2.3764

GARCH{1} 0.740395 0.0547972 13.5115

ARCH{1} 0.259605 0.100135 2.59256

DoF 2.82167 0.329997 8.55058

So which model choose now? Model with ![]() -distributed innovations seems to be promising. Let’s examine it quantitatively by AIC[9], BIC[10]. Before we can compare our models we need to infer log-likelihood objective functions for each of the model. We can also extract final conditional variances – volatilities.

-distributed innovations seems to be promising. Let’s examine it quantitatively by AIC[9], BIC[10]. Before we can compare our models we need to infer log-likelihood objective functions for each of the model. We can also extract final conditional variances – volatilities.

%% Infering volatility and log-likelihood objective function value from estimated AR-GARCH model [~,vG,logLG] = infer(EstMdlG,r); [~,vT,logLT] = infer(EstMdlT,r); %% Comparing fitted models using AIC, BIC % AIC,BIC % inputs: values of loglikelihood objective functions for particular model, number of parameters % and length of time series [aic,bic] = aicbic([logLG,logLT],[5,6],length(r))

we get

aic = 3752.3348 3485.1211 bic = 3774.9819 3512.2976

So both AIC and BIC indicate that AR-GARCH with ![]() -distributed innovations should be chosen.

-distributed innovations should be chosen.

Now we specify and estimate AR-GJR-GARCH adjusting for asymmetric volatility responses and compare it with better performing AR-GARCH with ![]() -distributed innovations using AIC and BIC. We will define just version with

-distributed innovations using AIC and BIC. We will define just version with ![]() -distributed innovations.

-distributed innovations.

%% AR-GJR-GARCH, ARIMA object

MdlGJR_T = arima('ARLags',2,'Variance',gjr(1,1));

MdlGJR_T.Distribution = 't';

%% Parameters estimation

% t-distributed innovations

EstMdlGJR_T = estimate(MdlGJR_T,r);

ARIMA(2,0,0) Model:

--------------------

Conditional Probability Distribution: t

Standard t

Parameter Value Error Statistic

----------- ----------- ------------ -----------

Constant -0.0784738 0.0895587 -0.876227

AR{2} -0.0714758 0.0347855 -2.05476

DoF 2.77131 0.325323 8.51864

GJR(1,1) Conditional Variance Model:

--------------------------------------

Conditional Probability Distribution: t

Standard t

Parameter Value Error Statistic

----------- ----------- ------------ -----------

Constant 1.34392 0.580147 2.31653

GARCH{1} 0.74785 0.0542454 13.7864

ARCH{1} 0.201164 0.0961537 2.09211

Leverage{1} 0.101972 0.113445 0.898867

DoF 2.77131 0.325323 8.51864

%% Infering volatility from estimated AR-GJR-GARCH model

[~,v_GJR_G,logL_GJR_G] = infer(EstMdlGJR_T,r);

%% Comparing fitted models using BIC, AIC

[aic2,bic2] = aicbic([logLT,logL_GJR_G],[6,7],length(r));

we get

aic2 = 3483.12113743012 3483.95446404909 bic2 = 3505.76823162144 3511.13097707866

therefore original AR-GARCH slightly outperforms AR-GJR-GARCH. Actually it is obvious from the output of AR-GJR-GARCH estimate because leverage coefficient is statistically insignificant.

Our resulting conditional mean and variance model is AR-GARCH with ![]() -distributed innovations

-distributed innovations ![]() in the following form

in the following form

![]()

![]()

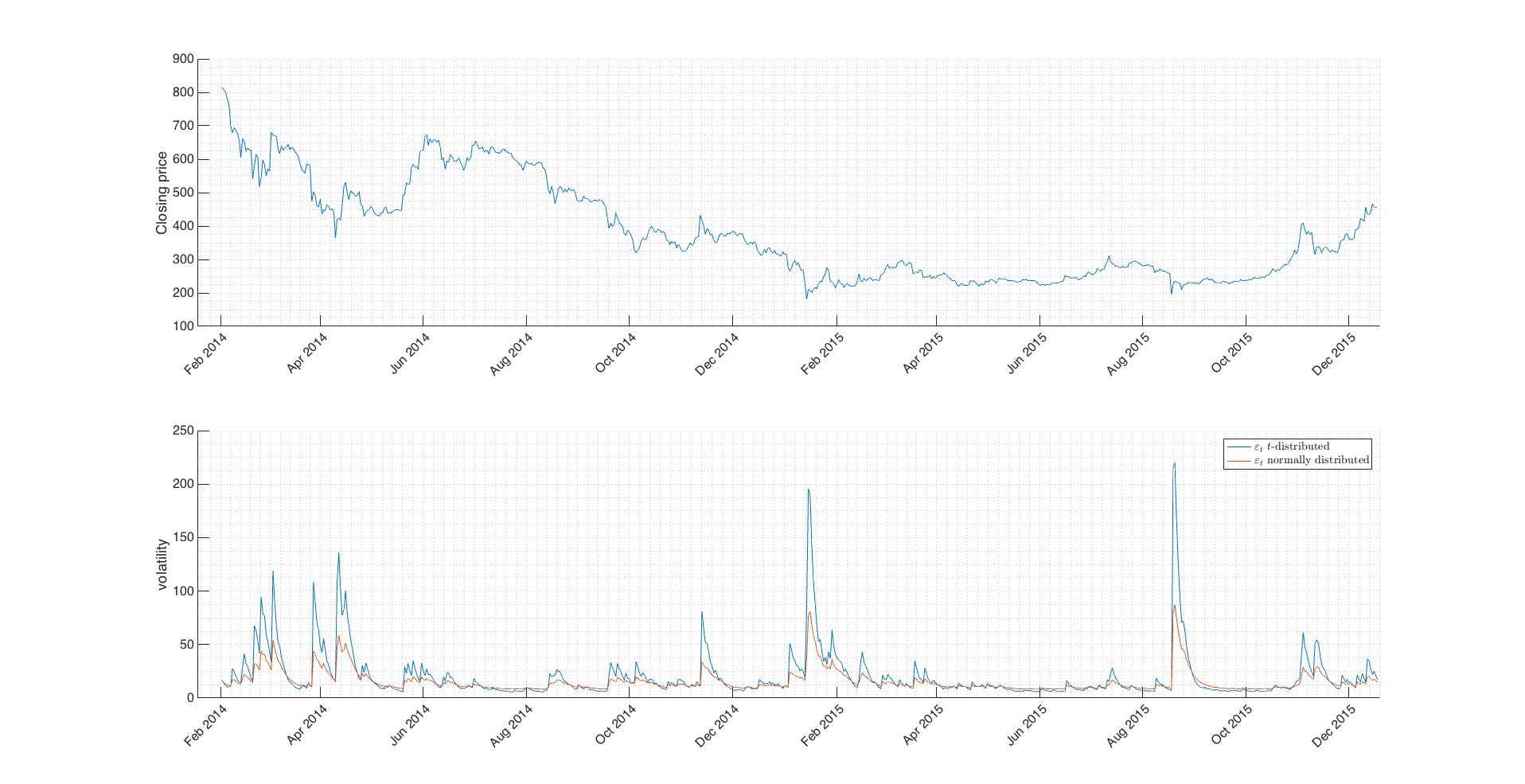

Let’s plot closing prices along with AR-GARCH with ![]() -distributed innovations and AR-GARCH with normally distributed innovations.

-distributed innovations and AR-GARCH with normally distributed innovations.

%% plot results

% Closing prices

figure4 = figure;

subplot7 = subplot(2,1,1,'Parent',figure4);

hold(subplot7,'on');

plot(date,C);

ylabel('Closing price');

set(subplot7,'FontSize',16,'XMinorGrid','on','XTickLabelRotation',45,'YMinorGrid','on','ZMinorGrid',...

'on');

% volatility AR-GARCH, innovations t-distributed

subplot8 = subplot(2,1,2,'Parent',figure4);

hold(subplot8,'on');

plot(date,vT);

% volatility AR-GARCH, innovations normally distributed

plot(date,vG);

ylabel('volatility');

legend({'

-distributed','

-distributed',' normally distributed'},'Interpreter','latex');

set(subplot8,'FontSize',16,'XMinorGrid','on','XTickLabelRotation',45,'YMinorGrid','on','ZMinorGrid',...

'on');

normally distributed'},'Interpreter','latex');

set(subplot8,'FontSize',16,'XMinorGrid','on','XTickLabelRotation',45,'YMinorGrid','on','ZMinorGrid',...

'on');

Fig.4 Comparison of generated volatilities. Difference between ![]() distributions is obvious.

distributions is obvious.

Download all code in one in GARCHestimation.m matlab script.

For purpose of this text we consider excess kurtosis as

![]()

where ![]() is fourth centered moment about the mean and

is fourth centered moment about the mean and ![]() is clearly squared variance of

is clearly squared variance of ![]() . PDF of the random variable

. PDF of the random variable ![]() with

with ![]() is respectively said to be platykurtic, mesokurtic or leptokurtic. ARCH models allow for leptokurtic distributions of innovations and returns.

is respectively said to be platykurtic, mesokurtic or leptokurtic. ARCH models allow for leptokurtic distributions of innovations and returns.

2. ![]() -algebra

-algebra

Suppose we have a vector of variances ![]() and a vector of values of dependent variable

and a vector of values of dependent variable ![]() . Let

. Let ![]() denote time. We can state that these two vectors contain information. Now consider arbitrary functions

denote time. We can state that these two vectors contain information. Now consider arbitrary functions ![]() , then information generated by

, then information generated by ![]() is considered to be

is considered to be ![]() -algebra generated by given set of vectors. So if we have whatever conditional variable it just means that we suppose its value is dependent on some other values through a function.

-algebra generated by given set of vectors. So if we have whatever conditional variable it just means that we suppose its value is dependent on some other values through a function.

3. AR process

Auto-regressive process AR(p) is defined as

![]()

After slight modification we can us AR(p) as

![]()

4. Just common denotations for one value, take a think just about last equality.

5. Ljung-Box test

Test whether any of a given group of autocorrelations of a time series are different from zero.

![]() : The data are independently distributed (up to specified lag

: The data are independently distributed (up to specified lag ![]() ).

).

![]() : The data are not independently distributed. Some autocorrelation coefficient

: The data are not independently distributed. Some autocorrelation coefficient ![]() is non-zero.

is non-zero.

6. ![]()

Familiar ![]() discussed by many students and practitioners forevermore. There are many intuitive interpretations of this value, some of them correct some of them not. I recommend you find your one which fits your mind best. For me personally it’s “the greatest significance level up to which we would not reject the null hypothesis”. Sometimes it’s being said to be plausibility because less

discussed by many students and practitioners forevermore. There are many intuitive interpretations of this value, some of them correct some of them not. I recommend you find your one which fits your mind best. For me personally it’s “the greatest significance level up to which we would not reject the null hypothesis”. Sometimes it’s being said to be plausibility because less ![]() is, less acceptable null hypothesis is.

is, less acceptable null hypothesis is.

7. Engle’s ARCH test

Engle’s ARCH test assess the significance of ARCH effects in given time-series. Time-series of residuals doesn’t need to be autocorrelated but can be autocorrelated in squared residuals, if so, we get familiar ARCH effect. Note that innovations figure as residuals.

![]() : The squared residuals are not autocorrelated – no ARCH effect.

: The squared residuals are not autocorrelated – no ARCH effect.

![]() : The squared residuals are autocorrelated – given time-series exhibits ARCH effect.

: The squared residuals are autocorrelated – given time-series exhibits ARCH effect.

8. T-test

We use one-sample T-test with hypotheses defined as

![]() .

.

![]() .

.

where ![]() is parameter in question.

is parameter in question.

9. AIC

Akaike’s Information Criterion (AIC) provides a measure of model quality. The most accurate model has the smallest AIC.

10. BIC

The Bayesian information criterion (BIC) or Schwarz criterion is a criterion for model selection among a finite set of models, the model with the lowest BIC is preferred.